In North Carolina, the legal process of dividing up and distributing the spouses’ property when a marriage ends is called Equitable Distribution. The presumption in Equitable Distribution is that marital property will be split equally; the “equitable” part refers to the fact that a court has the right to enter a different split based on the fairness of the whole picture. Note that “fairness” here refers only to the financial division of assets. Bad or unfair behavior during the marriage plays no role in Equitable Distribution.

The exception is if you and your spouse have signed a Prenuptial or Postnuptial Agreement. In that case your agreement will control the distribution of the marital estate.

You and your spouse can resolve all issues related to divorce (child support, child custody, alimony, post-separation support, and equitable distribution) through a negotiated separation and property settlement agreement. This will give you much greater flexibility and will allow you to resolve the issues between you creatively, so that both sides come away at least satisfied, if not completely happy. In order to arrive at a fair solution, though, it’s helpful to know what a court would do if it were called upon to make the determination.

The Three Categories of Property

North Carolina law divides the spouses’ property into three categories: marital property, separate property, and divisible property. Some assets may be mixed; for example, it is common for a retirement account to consist of both separate and marital property.

All property acquired after the date of marriage but before the date of separation is presumed to be marital property, no matter whose account it went into or how the property was treated during the marriage. Marital property is usually split equally between the spouses.

Separate property is anything that was acquired before the marriage or that was inherited or received as a gift during the marriage. Separate property belongs to the spouse who brought it into the marriage or inherited it.

The third category, divisible property, includes increases or decreases in the value of marital property after the date of separation but before the date the property is actually divided between the spouses. It also includes property acquired after the date of separation but that was based on efforts during the marriage (for example, a purchase that was negotiated during the marriage but isn’t actually finalized until after the parties have separated). Like marital property, divisible property is usually split equally between the parties.

Property Can Start Out Separate but End Up Marital

If one spouse individually inherits or is given money and maintains it in a separate account, where it passively accumulates interest, that money and its interest is counted as separate property and is not included in the marital estate. However, new contributions to that account made during the marriage – and the interest on those contributions – are marital property. And if the money is somehow given to the marriage – to buy the marital home for instance – or otherwise is commingled with marital assets, it becomes marital property.

Equitable Does Not Always Mean Equal

In some cases, marital and divisible property will be divided unequally. An unequal division may be fair when one of the spouses has long-term health problems, cares for a disabled child, has a large amount of separate wealth, or has taken steps to undermine the value of the marital estate, to name a few examples. The full list of factors that can be considered is listed here. [See the list under (c).]

What happens to the Marital Home?

A house that was purchased during the marriage is presumed to be a marital asset, and in most cases an equal division of its value is presumed to be equitable. One option is to sell the house and split the proceeds. However, if one person wants to keep the house, that person will need to buy the spouse’s share of the house. This can be done by trading assets (for example, A gives up her right to B’s retirement account in exchange for the marital home), or by refinancing and using the proceeds to buy the spouse’s share. When one spouse keeps the marital home, the other spouse will need to be removed from the mortgage. A well-drafted separation agreement will give very specific details about this process, including who pays for and prepares any necessary deeds, and the timing of payments and refinancing.

Business Interests

Unless otherwise provided for in a separate agreement, businesses begun during the marriage, or their growth during the marriage, are considered marital property. Valuation, division, and distribution can get complicated and expensive, and in most cases, new corporate documents reflecting the change in ownership will need to be drafted.

Pensions and Retirement Accounts

Money in retirement accounts earned during the marriage is no different from money in any other marital asset (i.e., it can be separate, marital, divisible, or some of each), but the actual division can be arduous. Many retirement plan administrators require a QDRO (qualified domestic relations order) signed by a judge. QDROs are notoriously easy to get wrong, but many plan administrators supply samples and offer to review drafts. Division of retirement accounts sometimes incurs early withdrawal penalties and may have tax implications; we may recommend you consult a tax professional in more complex cases.

How to Calculate the Division

- The first step is to create a thorough inventory

of the assets and debts that make up the marital property. We have compiled a checklist to help you remember the things like airline miles that might not immediately come to mind.

of the assets and debts that make up the marital property. We have compiled a checklist to help you remember the things like airline miles that might not immediately come to mind. - Then assign values to the items in the inventory, as of the date of separation. With bank accounts this will require you to look at the daily balance section of your statement. For high-value items like real property, works of art, jewelry, or a business, it is best to get an appraisal. Ordinary household items are valued at fair market value rather than replacement value – what they would fetch if they were sold on Craigslist or eBay or at a yard sale. In a negotiated settlement, you and your spouse can agree to use a different method of valuation – the tax value of vehicles, for example, or a fixed percentage of the purchase price. You should just be sure that whatever valuation system you choose is used consistently. Adding up the totals of every item will give you the value of the marital estate.

- Who gets what? This is where a negotiated settlement allows for maximum creativity and flexibility. A common starting point is for each spouse to keep their own retirement accounts. If one person has a far larger retirement account, and they want to keep it, they may have to give up other assets to make the division fair. Both your attorney and your mediator can help here.

- Equalize: When you add up what each person gets, assuming that a 50/50 division is equitable, you may find that one spouse needs to make an equalizing payment to the other. This is called the “distributive award.”

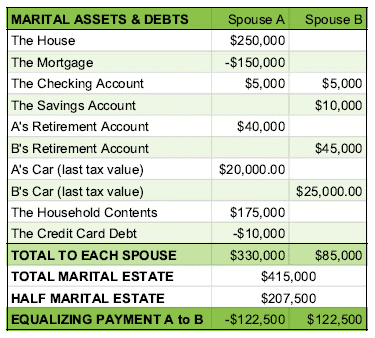

simple example of ED spreadsheet with equalizing payment

In this example, Spouse A needs to pay Spouse B $122,500 to even up the division of assets. This is a situation in which the couple will probably need to sell the marital home, since the value of the home cannot support the existing mortgage ($150K) and the distributive award.

- The Agreement: We recommend that you take the above steps with the guidance of your attorney and possibly a mediator. When you know how you want to divide your property, you and your attorney can think through the details of how all this should happen, and your attorney can write it up in a contract that carefully reflects both sides’ intentions. (Please see our page on separation agreements for more information.)